1. The Uncontrolled Massacre

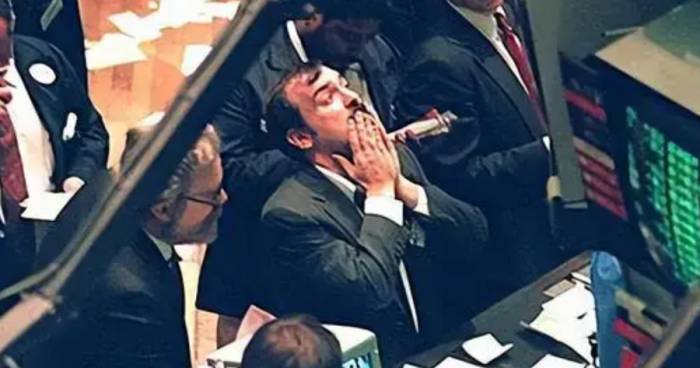

October 19, 1987, is a day that will go down in history for the global financial markets, known as Black Monday. On this day, the U.S. stock market experienced an unprecedented crash, with the Dow Jones Industrial Average plummeting by 508 points in a single day, a drop of 22.6%, marking the largest single-day decline in the U.S. stock market since 1914. Within 6.5 hours, the New York stock index lost $500 billion, a value equivalent to 1/8 of the United States' annual gross national product.

Almost all major companies' stocks plummeted by about 30%, such as General Electric falling by 33.1%, AT&T by 29.5%, Coca-Cola by 36.5%, Westinghouse by 45.8%, American Express by 38.8%, and Boeing by 29.9%.

The economist at the world-renowned investment group Merrill Lynch, Mr. Wachtel, referred to the stock market crashes on October 19 and 26 as "the uncontrolled massacre."

The massacre was not limited to the United States; the entire world suffered. For instance, the Hang Seng Index in Hong Kong plummeted by more than 11% on the 19th! In the early hours of October 20, the Hong Kong Stock Exchange urgently suspended trading for four days. Unexpectedly, when it reopened on October 26, it plummeted by 33.3% that day, setting a new record for the largest single-day decline in global history!

However, despite the severity of this stock market disaster, its actual impact was far less than that of the 1929 Great Crash. The U.S. stock market bottomed out on the day of the crash and reached new highs again within two years. Looking back now, it was just a larger ripple, with almost no effect on the super bull market of the U.S. stock market since the 1980s.

2. The Beginning of the Great Crash Was a Bull Market

In the early 1980s, the United States bid farewell to the era of stagflation, with energy prices continuing to decline and the information revolution in full swing.

Moreover, at that time, the U.S. government implemented the "new economic policy" to stimulate the economy, expanding fiscal spending, reducing taxes, and vigorously attracting foreign capital inflows. Coupled with tax exemptions for stock investments, global capital entered the U.S. stock market. This scene was praised by the American media as the "Reaganomics miracle." At the same time, interest rates continued to decline, and the stock market welcomed a super double play of valuation and earnings.By the end of September 1987, the S&P 500 Index had risen by 215% compared to its lowest point in 1982, with a cumulative increase of as much as 36.2% for the year.

A significant catalyst for this substantial surge was valuation, as the price-to-earnings ratio of the S&P 500 increased from less than 10 times to 20 times. In other words, most of this bull market was driven by valuation expansion.

Another crucial factor was the depreciation of the US dollar. Between 1985 and 1987, the US Dollar Index fell from a high of 164 to around 100, depreciating by nearly 40%. The end effect was similar to the reasons behind the recent surges in the stock markets of India and Japan. On one hand, currency depreciation can lead to a significant increase in the profits of listed companies when measured in local currency. On the other hand, it can also lead to an appreciation effect in the stock market, driving valuations higher.

However, compared to other stock market bubbles in history, the 1987 stock market bubble was quite small. The Cold War between the US and the Soviet Union was essentially over, scientific and technological advancements were making great strides, and the economy was flourishing. How could a valuation of 20 times be considered a significant bubble?

Therefore, when the stock market crash came, almost everyone was bewildered. There wasn't even a decent bearish news on the day of the crash. But, there must be a reason for everything, and there's no smoke without fire!

3. Is programmed trading to blame?

Many believe that the culprit of the 1987 crash was programmed trading, as computer technology made significant progress since the late 1970s, and investment based on mathematics began to gain popularity.

The renowned quantitative investment firm Renaissance Technologies is a product of this era, with Simons leading a wave of quantitative investment in the United States with the Medallion Fund.

Computerized trading can cause a chain reaction in the market when it declines. For example, at that time, programmed trading was mostly about buying on the rise and selling on the fall. A significant drop triggered a large number of similar stop-loss orders, leading to a short-term glut of sell orders that could not be liquidated, much like a bank run.

However, this explanation is not entirely accurate because quantitative trading was relatively popular in the United States at the time, but it was still a novelty outside of the US. For instance, Hong Kong had relatively few instances of it at the time.However, on October 19, 1987, the Hong Kong stock market, which opened earlier than the US stock market, plummeted by 11%, and this was not due to programmed trading! Therefore, programmed trading is not the only reason.

4. An Extraordinary Weekend

It is evident that something must have happened during the weekend preceding the Black Monday of 1987.

Firstly, there were reports that the US government was considering raising the capital gains tax, which formed a significant bearish factor for the stock market. At the same time, on Friday, October 16, the US House of Representatives proposed legislation to eliminate certain tax benefits related to financing mergers and acquisitions.

Secondly, in October 1987, data released at the beginning of the month showed that the US trade deficit and fiscal deficit were continuously expanding, and market confidence was severely questioned.

Lastly, over this weekend, the US Treasury Secretary announced that the dollar might be devalued proactively, triggering concerns about capital outflows.

This easily explains why the Hong Kong stock market collapsed first on October 19, as the Hong Kong dollar is directly pegged to the US dollar. The devaluation of the dollar implies the devaluation of the Hong Kong dollar, which also means that Hong Kong dollar assets and US dollar assets are about to face a massive sell-off.

Of course, in addition to these factors, there are other factors that also contributed to the significant crash of the US stock market.

On the afternoon of October 19, 1987, at 1:09 PM, a terrifying message reached the Wall Street stock market. The Chairman of the US Securities and Exchange Commission, David Ruder, made a speech in Washington stating: "At a critical moment, although we do not know when this critical moment will come, I will discuss temporarily closing the stock exchange with the stock exchanges."

This was intolerable and immediately triggered a massive sell-off. Although officials from the Securities and Exchange Commission clarified during the trading session that they had not discussed closing the stock exchange, the powerful negative feedback effect had already led the stock market into the abyss.5. Early Dragonflies Already Perched on Top

Looking back, the U.S. stock market at that time was not safe. Starting from the end of 1986, the U.S. inflation rate began to soar, and in just nine months, it rose to 4.3%!

To curb inflation, a rate hike cycle had already begun in January 1987. By September, before the stock market crash, the federal benchmark interest rate had increased from 5.88% to 7.25%.

Logically, with the start of the rate hike cycle and the rise in the cost of capital, the stock market should have fallen. However, in 1987, during the rate hike process, the U.S. stock market rose by more than 30%. This is somewhat similar to the current U.S. stock market.

However, the context at that time was a bit different from now. On February 22, 1987, the United States, Japan, the United Kingdom, France, West Germany, and Canada signed the Louvre Accord in Paris, France, ending the trend of dollar depreciation since the Plaza Accord in Japan. The Louvre Accord required member countries to further stimulate the economy through measures such as reducing fiscal deficits, tax cuts, and lowering interest rates to address imbalances in international trade (especially the trade imbalance of the United States itself). The expectation of the dollar's appreciation also drove the rise of the U.S. stock market since 1987.

However, as inflation in Europe rebounded, European countries led by Germany feared that lowering interest rates would worsen inflation and decided to raise interest rates in September of the same year (Germany raised short-term interest rates on October 14 and 15, and the dollar was once again seen as bearish), which angered Americans because this would require the United States to raise interest rates more to curb the trend of dollar depreciation.

Therefore, on the weekend of October 17, 1987, the statement by the U.S. Treasury Secretary actually declared the substantive bankruptcy of the Louvre Accord, and the stock market rise that the Louvre Accord could bring naturally needed to be readjusted.

6. Saving Confidence: A General Mobilization for Market Rescue

After the great crash, there was also a very rare market rescue, with the Federal Reserve directly printing money, which also provided a model for later rescues.

First, the White House issued a statement saying: "The national economy is running well, the employment rate is at its highest level, production is also increasing, and the trade balance is continuously improving. The Chairman of the Federal Reserve recently said in a speech that there is no sign that inflation will continue to occur."Secondly, on the evening of October 19th, President Reagan immediately recalled Treasury Secretary Baker, who was visiting West Germany, and Federal Reserve Chairman Greenspan, who was out of town, to closely monitor the development of the situation and discuss countermeasures together. The next day, both President Reagan and Treasury Secretary Baker publicly stated, "The stock market crash is disproportionate to the healthy U.S. economy, which is very stable."

Once again, on October 20th, before the U.S. stock market opened, the Federal Reserve issued an emergency statement, "To fulfill its central banking functions, the Fed officially announced today that it is ready to provide liquidity to support the economy and financial system." It supported commercial banks in continuing to issue loans to stock traders to prevent irrational declines due to a lack of liquidity.

At the same time, on October 20th, the Federal Reserve purchased a large amount of government bonds and lowered interest rates, causing the federal funds rate to drop by nearly 60 basis points that day, and officially cut interest rates on November 4th. The rules for lending bonds by the Fed were relaxed, and it was announced that the Fed was ready to inject funds into banks immediately. The Federal Reserve essentially directly entered the market, providing unlimited liquidity and greatly enhancing market confidence.

Finally, the U.S. government also provided funds to several large companies for stock buybacks. Faced with undervalued stock prices, within a week of the stock market crash, about 650 companies announced their intention to repurchase their own stocks in the open market.

Overall, in 1987, the Federal Reserve's market rescue was considered very active and effective. It was later proven that the day of the stock market crash was exactly the bottom of the market. The subsequent bull market also proved that the market decline was a limited adjustment.

In summary, looking back at the entire 1987 financial crisis, the reason why it did not cause a huge disaster was mainly because the economy itself did not have any major problems at the time. This crisis was just an internal adjustment of the financial system and did not involve the fundamentals of the economy.

The 1980s was a good time for economic development. First, the high-priced energy since the 1980s continued to decline, bringing continuous vitality to the economy. Second, the advancement of information technology was rapidly developing and having a very positive effect on the global economy. Third, the outcome of the U.S.-Soviet competition was determined, and the world returned to peace; fourth, China began to join the globalized camp.

This incident tells us that the randomness of the financial system is beyond the imagination of most people, and the fragility of finance is also beyond people's imagination. Once such a situation occurs, it is necessary to take decisive measures. In the absence of major economic problems, every crisis is a great opportunity to buy.